Bitcoin and EFTPOS

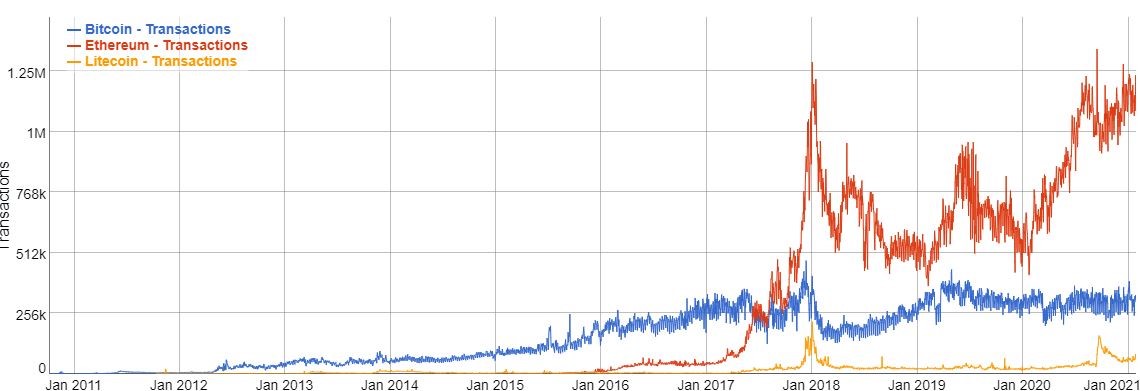

The combination of descriptions about NZ as a small, empty, remote island and news about Tesla buying lots of Bitcoin made me compare this graph of blockchain transactions per day (from Wikipedia, by user HocusPocus00)

with an infographic from paymentsnz for 2019.

There are about a third of a million Bitcoin transactions per day, and nearly 1.25 million Ethereum transactions per day. How does that compare with the NZ economy?

We get through about a million direct electronic transfers per day — when you send money from your bank account to someone else’s, like your plumber or a guy on TradeMe or splitting an accomodation bill with your mates. There’s about 360,000 direct debit transfers — when Vodafone sucks your phone and broadband bill out of your bank account. We have about 2.8 million EFTPOS debit transactions per day, and about 2.3 million credit card and PayWave transactions per day at point of sale (that was 2019; I’m guessing Paywave is up and EFTPOS is down in 2020).

Now, a single Bitcoin transaction can be more complicated than a single debit card purchase, and it might actually package a whole lot of transactions together (and, no, this isn’t quite like how a single supermarket debit card transaction might include toothpaste and cheese). It’s still a little surprising how few blockchain transactions there are.

Thomas Lumley (@tslumley) is Professor of Biostatistics at the University of Auckland. His research interests include semiparametric models, survey sampling, statistical computing, foundations of statistics, and whatever methodological problems his medical collaborators come up with. He also blogs at Biased and Inefficient See all posts by Thomas Lumley »

In spite of the rise in number and cumulative value of point of sale transactions the value of ‘cash in circulation’ (CIC) is also rising. According to RBNZ there was say $500 CIC per capita in 2000 and $1000 in 2014 and $1200 in 2017.

Cash is changing from a means of exchange to a store of value.

$100 notes very quickly disappear from everyday use.

4 years ago

A bitcoin block does package several thousand transactions together. However, I believe that chart of transactions is already looking at the underlying individual transaction data, not the number of bitcoin blocks. So it’s probably a reasonable comparison.

4 years ago

There are 40 million blockchain wallet users in comparison to 5 million of us in NZ. While NZ cleared $1.39 trillion NZD worth of EFTPOS+Credit card transactions in 2019. Bitcoin total value along hit $1 trillion USD this year. So its transactions in value must far exceed $1.39 trillion NZD. Thus per transaction value must be far higher for blockchian. This is a clear indication that blockchain users have different kind of buying habits. No surprise here! I am just not sure whether it is better to have a payment system used by many seldomly or few frequently. And there must be a reason why local cafes are not accepting Bitcoin but Tesla is.

4 years ago

Not all of the blockchain transactions are buying things. Many will just be selling other currencies to buy blockchain and some will be transferring money between accounts for other reasons.

4 years ago

Very true. So the comparsion reminds us that Bitcoin is still very much an investment/gambling tool rather than a payment system.

4 years ago

Theres that other problem with Bitcoin( and similar blockchain currencies)

“Lost Passwords Lock Millionaires Out of Their Bitcoin Fortunes

Bitcoin owners are getting rich because the cryptocurrency has soared. But what happens when you can’t tap that wealth because you forgot the password to your digital wallet?

Stefan Thomas, a German-born programmer living in San Francisco, has two guesses left to figure out a password that is worth, as of this week, about $220 million.”

https://www.nytimes.com/2021/01/12/technology/bitcoin-passwords-wallets-fortunes.html

I dont know personally , but its sounds like its very complicated passwords are essential to prevent others cracking it.

4 years ago